Receipt For Donation

The receipt doesnt not need to be any particular style. Step 1 Pick a form.

Donation Receipt Template Donation Letter Receipt Template Donation Form

Nonprofit donor receipts are written notes issued to a qualified donor after they have made a donation to an organization.

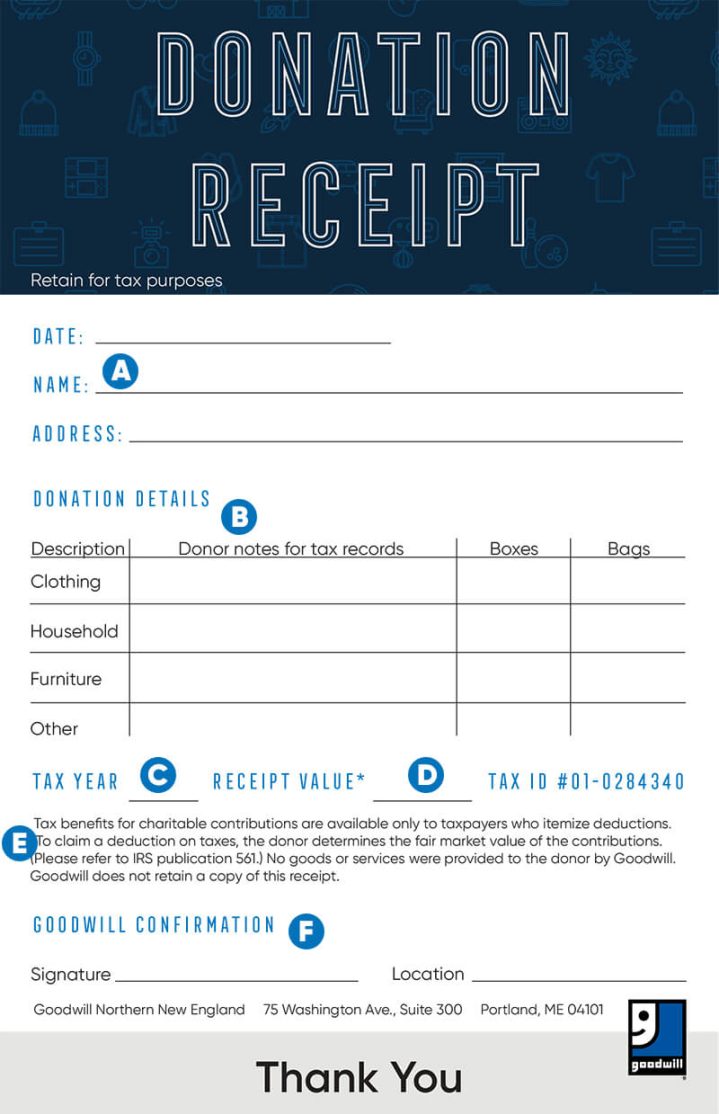

. Please keep your receipt for tax purposes and note that Goodwill SCWI does not retain a copy. XXX The serial number of the receipt. This is a letter thanking the person or the organization and at the same time acknowledging the person that you have received the needful.

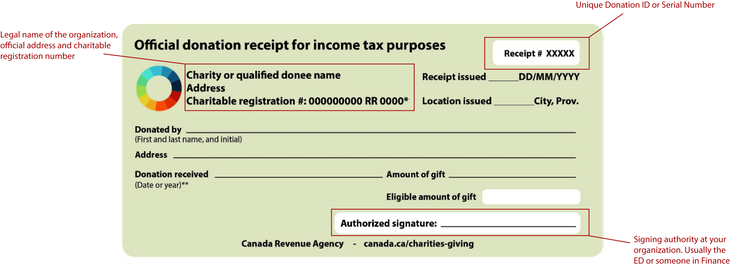

These donation receipts are issued when a donor receives a gift in return for a donation. A statement that identifies the form as an official donation receipt for income tax purposes. These notes serve as an acknowledgement that the gift monetary or non-monetary was received by the nonprofit.

Ad Download Or Email ACS Forms More Fillable Forms Register and Subscribe Now. Many nonprofits send receipts out by the end of the year the gift was given or. Its essential to have your own filing system.

Ad Donarius is The Fast Easy Way to Print or Email Donation Receipts. Each receipt must have its own unique serial number. No goods or services were exchanged for this donation.

Donation Receipt 2022 If you have not received your email please make sure to check the spamjunk folder for the receipt. A donation receipt is proof that a donor made a monetary or in-kind contribution to an organization. 3 best practices when writing donation receipts 1.

501 c 3 charity donation receipt is written by the charity organization upon receiving contributions worth 250 and above. While sending a donation receipt is only necessary for gifts over 250 its advisable to send a separate receipt for each donation. Store copies of donation receipts.

If you ever need proof of a donation a copy of a receipt or to reissue a receipt your filing system will be your best friend. Our site shows when receipts are sent viewed by your customer and accepted or declined. This could be in the form of merchandise a meal or any services charities provide in exchange for donations.

The donation receipt may be issued by your charity organization or group to document the receipt of a donation. Remember to say thank you Donation receipt letters may have some formal requirements but theyre also an opportunity. This document provides information about the transaction such as the date and amount of donation who received it eg organization name and any other explanations for why it is presented eg in honor of or a title of the organization.

501c3 Donation Receipt Template. 1 Legal Form library PDF editor e-sign platform form builder solution in a single app. To place it simply donation receipts are concrete proof or evidence that a benefactor had made a contribution whether in-kind or monetary to a group association or organization.

It is a good practice. Thank you for your donation. Donation receipt sample letter is the acknowledgment letter for receiving the amount of donation that you asked for either in the form of money or in kind.

The taxable amount must take into account the cost of the gift and therefore requires a different donation receipt. No goods or services can be traded for the donation amount in order for it to be tax-deductible. Donarius is The Fast Easy Way to Track Donors Issue Receipts.

And this receipt is detailed enough to answer questions like who is the donor who is the recipient or what type of gift is given in the first place. Goodwill SCWIs tax ID number is 39-114-7571. Note that while you should still issue receipts for individual donations it is also good practice and sometimes required to send an end-of-year donation receipt that encapsulates the total amount donated by a given donor.

The charity organization that receives the donation should provide a receipt with their details included. A donation receipt is basically the official receipt used to document a donors gift to a charity or any recipient. Donation receipts can be used to help with bookkeeping and to keep track of a donors history with your organization.

In the US all types of registered 501 c 3 charitable organizations and registered 501 c non. We do not sell trade barter or share customer lists or our customers private information with any other businesses or people. As long is it includes the appropriate information it will fulfill the purpose of a donation receipt1 X Research sourceStep 2 Include your name and your status.

Read our full privacy policy. Keeping track of the donation receipts youve issued just makes good sense and keeps everything in order. It acknowledges that a gift was made to you and that the receipt contains the information required under the Income Tax Regulations.

Often a goodwill donation receipt is presented as a letter or an email which is given or sent to the benefactor after the donation has been received. A donation receipt is a form of receipt that shows concrete evidence that a benefactor had donated a given value to a beneficiary. Ad Save time get organized and look professional with our fully customizable template.

The receipt is important to the donor who gives out cash vehicle or personal property and wishes to have a tax deduction on the donation. Non-profit receipts are given when a donor donates to a nonprofit organization. Whether youre creating a receipt for a general donation form on your website or for a specific fundraising campaign one of the essential components is creating a donation receipt that will get automatically sent to donors following their donation.

An end-of-year donation receipt is often confused with a donation receipt for a fulfilled end-of-year donation letter. Avoid promising tax deductions A charitable donation receipt doesnt promise anything to a donor in terms of how. With automatic donation receipts you have the ability to immediately acknowledge your donors gift which has been proven to increase.

That is it can be a letter a postcard an email or a form you fill in and hand to the donor for instance. Please note that it is the responsibility of the donor to determine fair market value of the items donated. One of the most important items to.

They are often letters or emails sent to a supporter after a donation has been made.

Nonprofit Donation Receipt Letter Template

What Do Gofundraise Receipts Look Like Gofundraise Customer Care

Free Donation Receipt Template 501 C 3 Word Pdf Eforms

Donation Receipt Template Pdf Templates Jotform

Free Donation Receipt Templates Samples Word Pdf Eforms

Free Salvation Army Donation Receipt Word Pdf Eforms

Donation Receipt Template Download Printable Pdf Templateroller

Nonprofit Donation Receipts Everything You Need To Know

How To Fill Out A Goodwill Donation Tax Receipt Goodwill Nne